Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

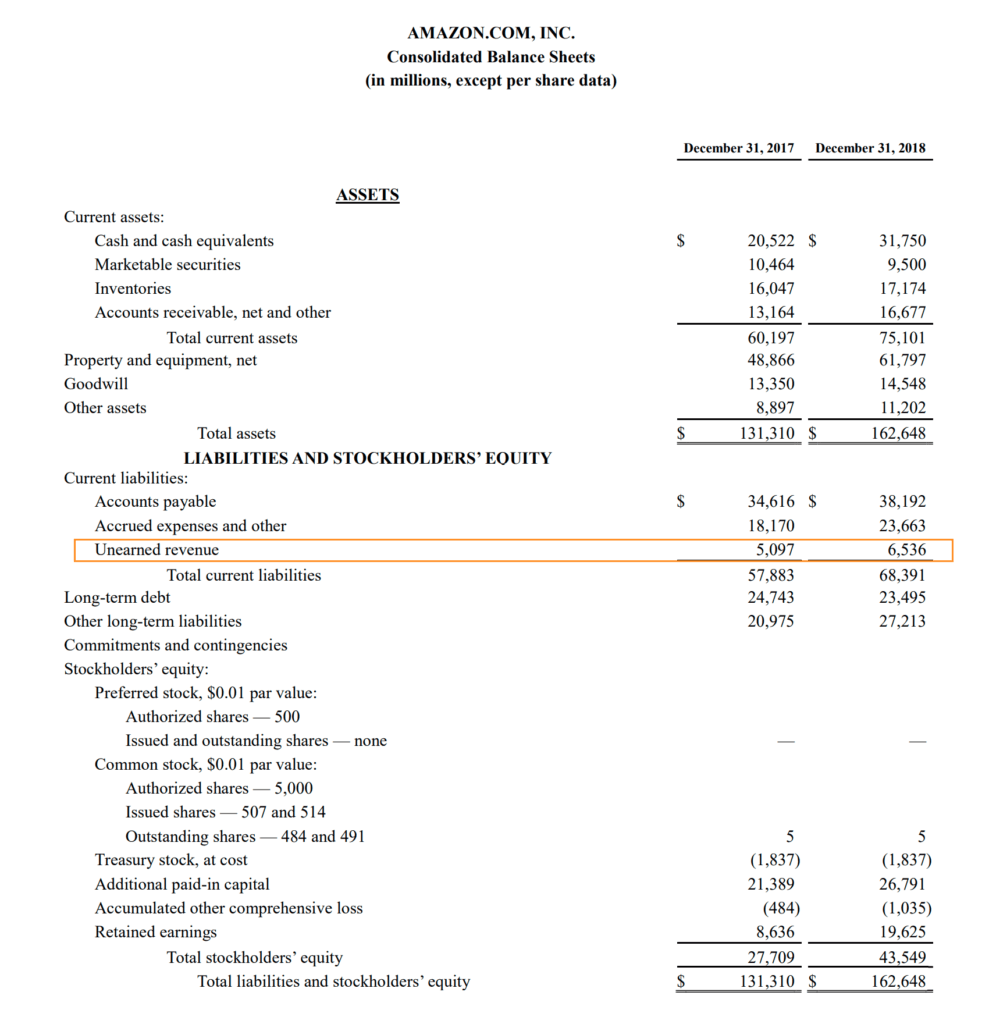

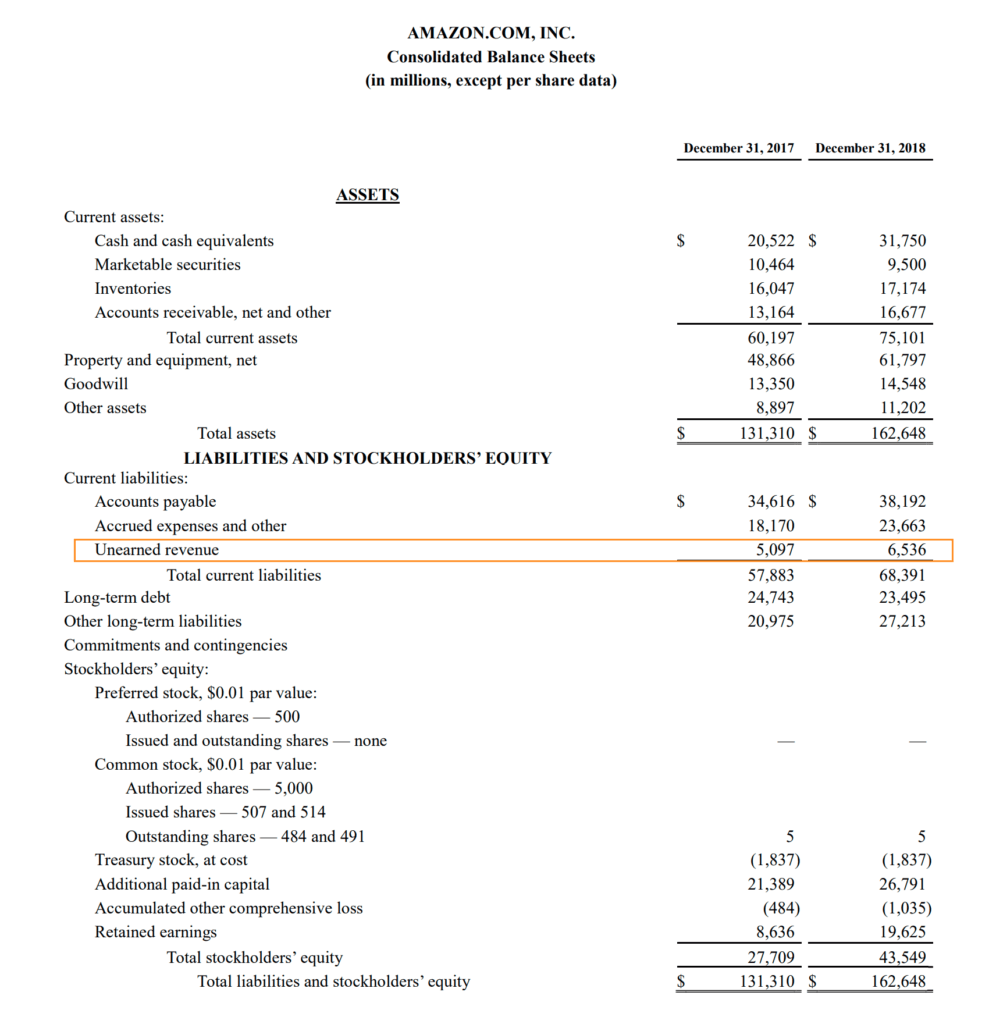

Deferred Revenue (also called Unearned Revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. In accrual accounting , revenue is only recognized when it is earned. If a customer pays for goods/services in advance, the company does not record any revenue on its income statement and instead records a liability on its balance sheet .

Let us look at a detailed example of the accounting entries a company makes when deferred revenue is created and then reversed or earned.

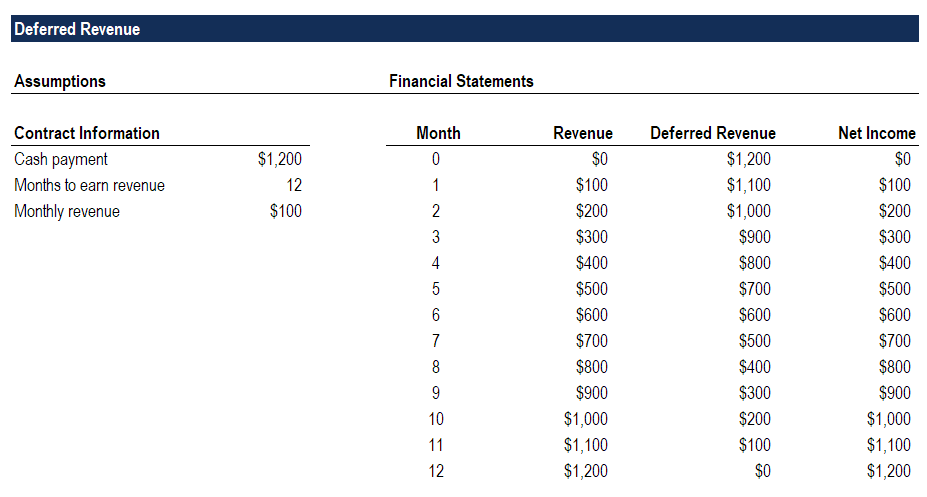

On August 1, Cloud Storage Co received a $1,200 payment for a one-year contract from a new client. Since the services are to be delivered equally over a year, the company must take the revenue in monthly amounts of $100.

On August 1, the company would record a revenue of $0 on the income statement. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created.

On August 31, the company would record revenue of $100 on the income statement. On the balance sheet, cash would be unaffected, and the deferred revenue liability would be reduced by $100.

The pattern of recognizing $100 in revenue would repeat each month until the end of 12 months, when total revenue recognized over the period is $1,200, retained earnings are $1,200, and cash is $1,200. At that point, the deferred revenue from the transaction is now $0.

Download CFI’s Deferred Revenue template to analyze the numbers on your own.

The simple answer is that they are required to, due to the accounting principles of revenue recognition. In accrual accounting, they are considered liabilities, or a reverse prepaid expense, as the company owes either the cash paid or the goods/services ordered.

The timing of customers’ payments can be volatile and unpredictable, so it makes sense to ignore the timing of the cash payment and recognize revenue when it is earned.

We’ve seen what happens to the income statement and balance sheet. Now, let’s look at the impact on the cash flow statement.

Referring to the example above, on August 1, when the company’s net income is $0, it would see an increase in current liabilities of $1,200, which would result in cash from operating activities of $1,200.

In all subsequent months, cash from operations would be $0 as each $100 increment in net income would be offset by a corresponding $100 decrease in current liabilities (the deferred revenue account).

Thank you for reading CFI’s explanation of Deferred Revenue. To keep learning and advancing your career, the following CFI resources will be helpful: